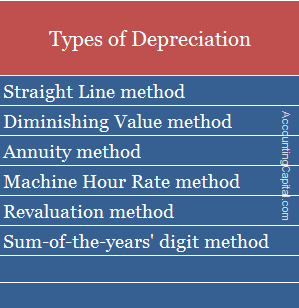

Explain Depreciation and Its Difference Methods

First among types of depreciation methods is the straight-line method also known. Depreciating Rate Per Unit 0001.

What Is Depreciation Types Examples Quiz Accounting Capital

What is Depreciation and its Types.

. Amount of depreciation goes on reducing every year. Depreciation is a reduction in the value of a tangible fixed asset due to normal usage wear and tear new. The 150 declining balance depreciation method is a slightly slower version of the double declining balance method.

In this method depreciation of the asset is done at a constant rate. Do you know what book value is compared to market value. In previous article we have covered the definition of depreciation expense of property plant and equipment PPE as well as other fixed assets and the basic understanding on types of depreciation methods.

Straight Line Depreciation Method. Discounted Cash Flow Method. Reducing balance method.

Straight-line depreciation is the most simple and commonly used depreciation method. Double Declining Balance Method. Depreciation is charged to spread the cost of an asset over its useful life.

Annual Depreciation fracOriginal Cost - Estimated Scrap ValueEstimated Useful Life 2. Activity method of depreciation. The difference between the straight-line method of depreciation and the diminishing balance method of depreciation is as follows.

Methods of recording depreciation. 1 Straight-line depreciation method. It is easy to calculate the rate of depreciation.

There are mainly four standard methods of depreciation. In this article we will further explain in detail of each type of depreciation method including the calculation when to use it as well as the advantages and disadvantages. Depreciation is charged on the purchase price of the asset for all years.

Depreciation fund method or sinking fund method. Depreciating Rate Per Unit 108000 8000 100000000. A company can adopt any of these methods of calculating depreciation depending on its needs.

Three of these methods are based on time while one is based on actual usage. Two main ways exist in calculating depreciation and they are the straight line which allows deducting the same amount each year over the life of the asset and reducing balance method declining balance method which provides for a higher charge in the first year and reducing amount throughout the asset life. The four main depreciation methods.

Straight Line Method SLM In this method equal amount of depreciation is charged on the asset over its useful life. This method has taken from the declining balance method with a difference that this is more rapid in its action. Methods and Types of Depreciation.

Reducing balance method. There are four main depreciation methods. Depreciating Rate Per Unit Cost of Bottling Machine Salvage Value Total number of bottles filled during the useful life of bottling machine.

Click here to learn more. It involves the simple allocation of an even rate of depreciation every year over the useful life of the asset. The straight-line method of.

Declining balance depreciation Book value Straight line depreciation percent x 15 150 Declining Balance Example. This method should be used in those assets where high depreciation should be charged in initial years. Its aim is to distribute the cost of the depreciable asset over its useful life and charge the depreciation to the Profit and Loss Ac in order to arrive at the correct profit or loss for the year.

Iii It is not a process of valuation of asset. The Double declining method depreciates assets even more aggressively and facilitates creating better profits when the asset is sold. Ii Depreciation is a gradual and continuous process because value of asset is reduced either with use of asset or due to expiry of time.

Depreciation number of bottles filled in a given year depreciation. This method involves applying the depreciation rate on the Net Book Value NBV of asset. Annual Depreciation expense Asset cost Residual Value Useful life of the asset.

For Example asset is purchased for rs. Sum of the years digits. Straight line method of depreciation.

The differences between the 2 methods are. Depreciation is calculated using the following formula. 150 Declining Balance Depreciation Formula.

Calculation Easy or Difficult. Iv Depreciation reduces the book value and not the market value of the asset. Annual amount of depreciation under Straight Line Method.

The reduced balance is the cost of the asset less depreciation to date. The term depreciation refers to an accounting method used to allocate the cost of a tangible or physical asset over its useful life. Some of the methods for calculating depreciation are.

Written down Value method. A fixed percentage is written off the reduced balance each year. Cost of the asset-residual value nr of years an asset is expected to be used for.

Machine hour rate mileage and global method. It is the process of allocating cost of an asset to its effective life. Therefore the concept of depreciation and its accounting is the process of allocating or apportioning the cost of the fixed assets over their useful life.

Various Depreciation Methods. Amount of depreciation remain fixed thought out the life of the asset. Depreciation is charged on written value at the beginning of each year.

It is a permanent and continuous decreases in the value of an asset. Sum of Years Digits Method. Instead of using twice the straight-line value it uses 150 or 15x.

100000 and useful life is 10 years with salvage value of Rs. In this method depreciation charges reduces each successive period. Rate of depreciation fracAnnual DepreciationOriginal Cost of Asset X 100.

25000 - 50050000 x 5000 2450. This is the simplest method of all. It is difficult to calculate the rate of depreciation.

ABCs depreciation expense is 2450. 9000 for each of the 10 years. Rate of depreciation on original cost.

So let us study the methods of calculating depreciation in detail. Depreciation is calculated on the value of the depreciable assets like building plant machinery furniture loose tools etc. The formula for straight-line depreciation is.

Sum of the years digits method of depreciation. Depreciation is caused due to use efflux of time obsolescence etc. Depreciation represents how much of an assets value has been.

Asset cost - salvage valueestimated units over assets life x actual units made. 10000 then depreciation is charged at Rs.

Depreciation Definition Types Of Its Methods With Impact On Net Income

What Is Depreciation Definition Objectives And Methods Business Jargons

No comments for "Explain Depreciation and Its Difference Methods"

Post a Comment